About this image :-

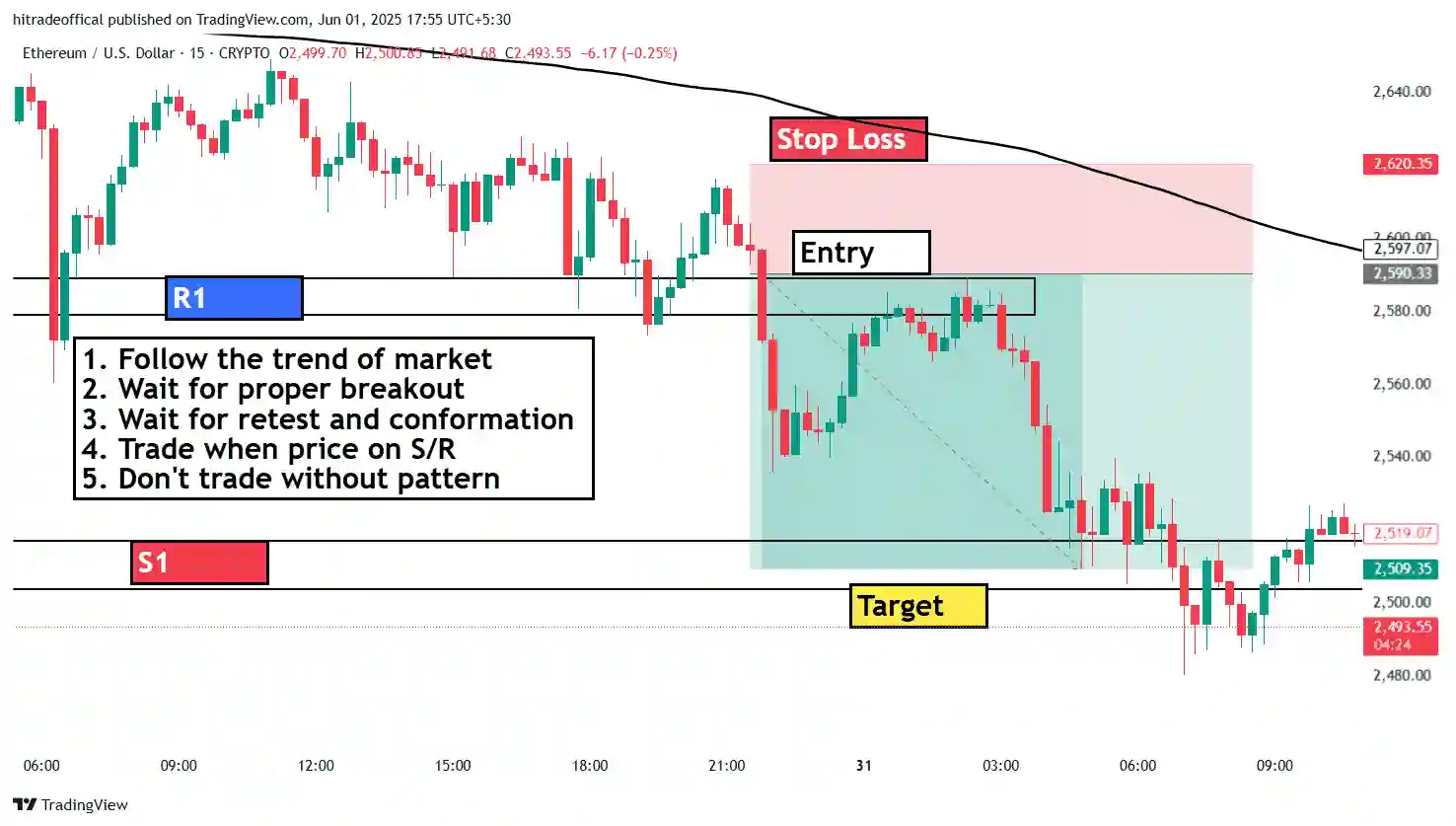

In this image you can see that a trap is form and after some time a bearish candle is also form and price moving down side. So in this post talk about how to find trap and how to plan our trade.

Welcome to this post now keep learning and careful learning.

What is trap trading :-

When form any pattern like form bullish pattern and price behave like bearish pattern than this process is called trap in trading.

The trap trading is simply meaning by price action making other pattern and work is different that is called trap trading.

In trap trading there are lots of loss and also lots of profit like when you can trap trading than you can make money more as compare to your before trading.

If you want to learn this trap trading you can take help our site as well as this post in this post we learn all things about trap trading.

How to find trap in live market :-

If you want to find trap in live market than you can follow these steps.

The first step is open your top 500 stocks list from your index.

The second step is start seeing chart and select those stocks which form any type pattern.

The third step is now wait for formation any pattern.

The fourth step is when form any pattern than again wait.

The fifty step is after form first pattern than form second pattern.

This formation of second pattern is called trap. This is a good or original method for find trap in market.

Which price action work after form trap :-

The answer is here doesn’t matter to which price action work after form trap in short here the main thing is how you identify price action.

In trap trading mainly the first price action is trap in maximum case and after making first price action the chart again make second price action.

This second price action is work for trading and also for profit. So if you our post image than here first breakout is take place.

After breakout you can say that make a double bearish candlesticks and price move suddenly in down side. This price action work in this image.

So finally, we can say that in different chart make price action in different form so it is fully depend upon chart and chart pattern.

How to plan our trade in trap trading :-

If you want to plan our trade in trap trading than first to first you need to follow some steps.

The first step is open chart those stock which make some type of pattern.

The second step is wait for any big movement.

The third step is if any movement is take place than again wait for making second movement.

The fourth step is if second movement is form with candle sticks pattern than

The fifth step is measure your stop loss and if stop loss is your range than you can trade.

These are some steps with the help of this you can plan our trade in trap trading.

Here, we talk about practical method if you follow this method than you can easily make profit.

When we can sell using trap :-

If you want to sell using trap or trap trading than first to first you need to follow our golden rule and our golden rule is ” Don’t trade without any pattern “.

When form any pattern or any movement than the your first work is mark that chart form any chart pattern or any movement.

After formation of pattern you need to wait for making trap or price action like candle stick pattern.

When candle stick pattern is form than measure your stop loss and if the candle sticks is bearish than you can sell using trap.

This way you can easily sell using trap or trap trading.

Can we buy using trap or not :-

Yes, you can buy using trap. But first to first you need to conform your trap making bullish price action than you can buy using trap.

Because may be trap is bullish and also some time may be trap is bearish so that depend upon price action we can buy or not.

What is our entry point :-

In this image our entry point is after formation of double bearish candle stick pattern like in you can see that our entry point direct in image.

In number form our entry point is 435 for selling. Now if you are learning this post so don’t try to entry now using our price action.

Because our price action is back test if you want to trade or entry in any stock so you can check current price action and see what is making in this time.

If price action is according to you than you can trade otherwise don’t try to take entry without any pattern or price action. This is notice for every trader.

What is our stop loss point :-

In this trade our stop loss is high of last second entry candle and also you can see in our image and we also mark stop loss line.

If you want to know what is stop loss in number than the number is 438 or 440 this is round number. This is our stop loss point for that trade.

Again, Notice this is previous stop loss according to this stop loss don’t try to take entry because this post is back test or previous pattern or price action.

What is our target point :-

If you want to find your target in any trade than you can take help our two methods.

The first method is you can use random or round figure number like you can plan your target 10% out of your capital. This is very useable method to book your target.

The second method is you can use recent support or resistance like in this image you use this method you can see for target we draw a line.

If you want to know what is our target in number than the number is 425. This is our target point zone and also you can use trailing stop loss for achieve good target.

Here, lots of people will confused due to our number so now don’t confuse because in this post we learn about selling target not buying target so our number will decreases form 435 to 425.

When we are taking target in buying side that time our number will increase for profit. But in selling side our number will decreases for making profit.

This way you can achieve your good target point. I wish you all try to make good profit.

What is the learning of this post :-

There are lots of learning in this post like that you can learn line by line.

The first learning is what is trap trading.

The second learning is how to find trap in live market.

The third learning is which price action work after form trap.

The fourth learning is how to plan our trade in trap trading.

The fifth learning is when we can sell using trap.

The sixth learning is can we buy using trap or not.

The seventh learning is what is our entry point.

The eighth learning is what is our stop loss point.

The ninth learning is what is our target point.

These are whole of the learning of this post. If you want to learning these things than you can take help this title.